When boating season winds down, many owners haul their vessels out for inspection, repair, and storage, making winter one of the busiest times for boat repairers — and one of the riskiest.

Fortunately, the right insurance protection can make all the difference between a smooth, profitable off-season and a stressful, expensive one. But that means you can’t rely on a general liability (GL) policy. You need comprehensive ship repairers liability coverage, also known as a marine general liability (MGL) policy.

Liability Risks During the Off-Season

If you’re a boat repairer during the winter, you probably have more boats than usual packed into your repair yards. You may have more maintenance projects underway, and the potential for property damage, workplace injuries, and environmental hazards can go up significantly.

Property Damage

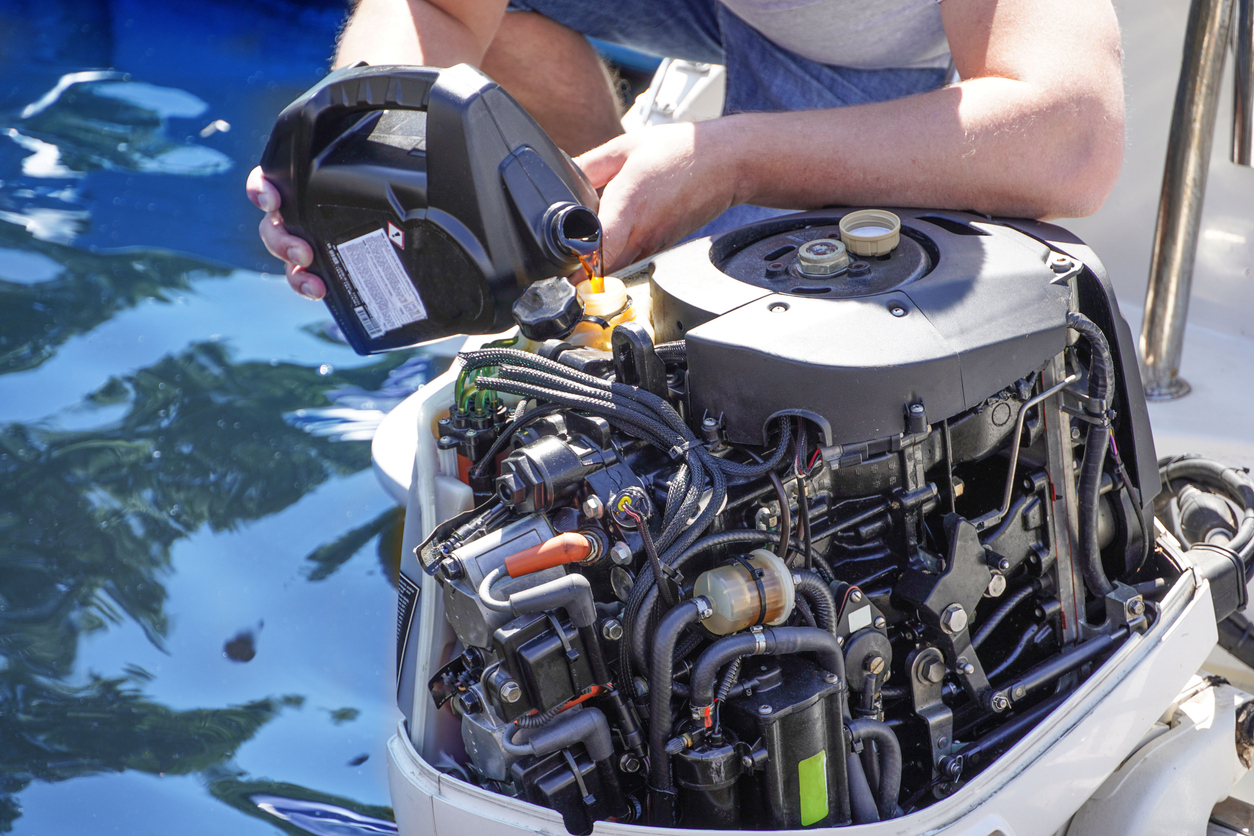

Off-season maintenance often involves hull work, refinishing, or engine repair — jobs that require specialized tools, heavy equipment, and sometimes open flames or chemical agents. Common repair issues include electrical malfunctions, engine failure, and hull damage.

Your clients are coming to you for help because you’re an expert boat repairer. But you’re human, and even in this age of artificial intelligence, humans work for you. Mistakes can lead to fires, structural damage, or equipment loss.

If that happens, vessel owners will want compensation. That, of course, is where a good insurance policy comes in.

Injury and Safety Hazards

With multiple crews working simultaneously in tight spaces, the likelihood of slips, falls, and crush injuries rises — especially when wet decks, power tools, and uneven surfaces are involved. Reduced off-season staffing can also lead to gaps in the oversight of safety procedures.

Environmental Hazards

Fuel leaks, improper waste disposal, and chemical spills can lead to environmental damage and costly cleanup obligations. Winter storms and flooding add further risks, particularly for waterfront facilities. Combined with increased vessel density and reduced supervision, these factors make the off-season one of the riskiest times of year for repair yards.

How Ship Repairers Liability Insurance Protects Businesses

A comprehensive ship repairers liability policy is built specifically for marine operations. It covers incidents that general business policies — like standard GL — typically exclude.

What It Covers

Ship repairers liability coverage protects your business from:

- Damage to vessels under repair: If a customer’s yacht or boat is scratched, dented, or damaged during maintenance or testing, your policy may pay for repairs or replacement.

- Third-party injuries: The policy covers bodily injury to non-employees, including customers, contractors, and marina visitors.

- Legal defense costs: Coverage typically includes attorney fees, settlements, and judgments if your business faces litigation related to repair operations.

How It Differs from General Liability

Many repairers assume a standard GL policy is enough, but it really isn’t. GL policies are designed for typical land-based businesses and usually exclude:

- Damage to vessels in your care, custody, or control

- Accidents occurring on or near water

- Faulty work that leads to vessel damage or malfunction

By contrast, marine general liability (MGL) or specialized ship repairers liability policies are built for waterfront work. They cover:

- Damage to vessels while being repaired, launched, hauled out, or tested

- Accidents occurring from a skiff, dock, or floating platform

- Subcontractor activities under your direction

The bottom line: standard GL policies protect your premises, but ship repairers insurance protects your business’s core operations.

What Should Boat Repairers Review Before Winter Work Begins?

Before the off-season begins, review your insurance policies and confirm that they align with your current operations. Key considerations include:

- Coverage limits: Ensure your policy limits reflect the total value of vessels in your yard at any one time.

- Subcontractor clauses: Verify that subcontractors carry their own marine liability coverage, and that your policy clearly defines their responsibilities.

- Off-site work: Confirm you’re covered for mobile or on-location repairs, test runs, and temporary storage areas.

- Seasonal staffing changes: Inform your insurer if you hire temporary workers or expand your crew.

Especially for new or growing repair operations, being well-insured and protecting your boat repair business is crucial. Otherwise, one innocuous error or accident could financially devastate and sink your business.

Why Work With a Marine Insurance Specialist?

Marine repair operations face unique exposures that traditional insurers may not fully understand. Before the next busy season begins, take time to check whether your liability coverage protects you against off-season risks.

Partnering with a marine insurance expert like Mariners ensures your coverage will be customized for your demands, whether in the off-season or not, from haul-out to refit to re-launch.

With decades of experience protecting shipyards, marinas, and marine artisans, Mariners Insurance can help you identify potential coverage gaps and tailor a policy that fits your business operations, workforce, and customer base.

About Mariners General Insurance Group

Mariners General Insurance Group was founded in 1959 to protect boat owners and marine business clients. We are marine insurance experts and insure boats worldwide — in every ocean on the planet. Marine insurance is critical if you own a boat or nautical business. Trust the professionals with all of your boat Insurance needs — trust Mariners Insurance. Call us at (888) 402-5018 any time you have questions or concerns about insurance for your vessel or marine business.